Markets in Focus - June 2025

Rising US/China and global conflict over tariffs, along with US and Israeli bombing of nuclear facilities in Iran, caused short-lived dips in global financial markets in June, but by month-end, indices had firmed on the hope of easing trade tensions.

Early in the month, a tariff war between the US and China seemed likely to escalate, but by month-end, China had agreed to relax restrictions on rare earth sales to the US. Although tensions remained between the US and Canada over tariffs, by the last week of June, President Donald Trump’s attention appeared to have been shifted to efforts to get his “One Big Beautiful Bill” accepted by both his party and the US Congress. Reaction to the revised tariffs on 9 July are yet to be seen.

US economic data releases are starting to show early signs of a slowdown, but the majority of economists are not forecasting a recession yet. The unemployment rate was unchanged at 4.2% in May as the economy continued to add jobs. However, there were subtle signs of weakening manufacturing and services activity, as well as ebbing business and consumer confidence. The US Federal Reserve is expected to cut rates at least once more this year.

In Europe, the central bank has once again cut rates by 25 bps as inflation stayed under control. Europe’s manufacturing sector, which has been faltering since mid-2022, appeared to be stabilising, with the Hamburg Commercial Bank (HCOB) Eurozone Manufacturing PMI reaching a 33-month peak, though not yet in expansionary territory.

In SA, the inflation rate has remained stable at below 3% but employment numbers contracted again in the first quarter. Another crisis in the Government of National Unity seemed imminent over the sacking of deputy trade minister Andrew Whitfield, a DA appointee, from the Cabinet, but the DA resolved to remain within the GNU.

Both US and emerging market equities delivered strong returns in the month. US equities were boosted by gains in tech shares, with the Nasdaq gaining more than 6%. Chinese equities were encouraged by the government’s measures to stimulate the economy, as well as the trade deal with the US. In SA, a surge in the platinum price drove PGM share prices upwards, but even those share gains were beaten by Telkom – which rose 38.6% for the month on news that it would resume dividend payments.

The rand gained 1.5% against the dollar in June.

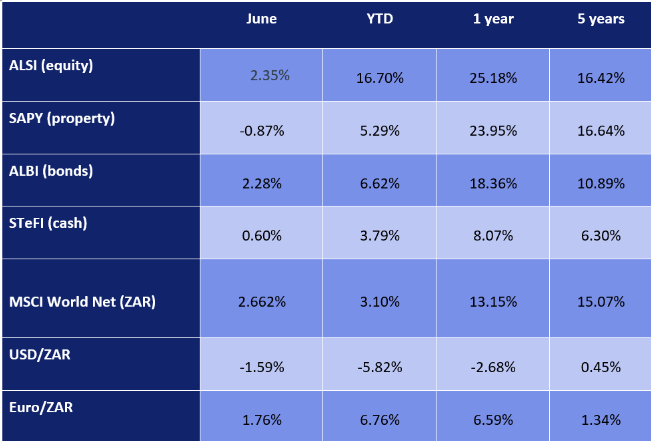

In dollars, the MSCI World Index gained 4.3% month-on-month, but in rands the gain was a more modest 2.66%. The JSE All-Share Index returned 2.35% for the month, taking its one-year gain to 16.7%. The weakest sector was property, with the SAPY delivering a negative 0.87% for the month, though it has still delivered a strong one-year return of 23.95%.

Table 1: Total returns to 30 June 2025