April 2025 proved to be a volatile month for markets, with tariff announcements and roll-backs creating worldwide uncertainty. Global and local market risks escalated due to tumultuous shifts in trade policies, which drove nervous investors to seek refuge in gold as a safe haven.

On the world stage, US President Donald Trump’s initial announcements of steep import tariffs on US trading partners were followed by a pause for negotiations, then the exemption of various goods and a number of roll-backs. At month-end, US/China trade tensions had begun to ease.

Although the S&P 500 ended the month in positive territory, ongoing upheaval and uncertainty around policy have driven asset managers to question “US exceptionalism” and diversify portfolios into other markets. The US Dollar Index weakened by 8.4% against a basket of major currencies in the four months to the end of April.

The potential inflationary effect of import tariff hikes on US consumers, along with the continued strength of key economic data, could persuade the US Federal Reserve to slow the pace of interest rate cuts this year. Consumer inflation fell to an annualised 2.4% in March from 2.8% in February, while producer inflation was 2.7% (February: 3.2%). Non-farm and local government employment rose in March, although the manufacturing PMI indicated a slowdown in new orders.

In Europe, the relaxation of rules limiting spending on defence, along with an increase in Germany’s defence budget, raised hopes of stimulus for sluggish economies. The European Central Bank cut interest rates by another 25 basis points mid-month. In Q1 2025, seasonally-adjusted GDP in the euro area grew by 0.4% quarter-on-quarter, following a 0.2% increase in Q4 2024.

In South Africa, investors watched with concern as political parties tussled over the ANC’s plans to hike the VAT rate by 0.5 percentage points in 2025 and again in 2026 – a move it was feared would intensify pressure on already-stressed consumers. By month-end, the Finance Minister committed to exploring alternative revenue-raising measures. He will announce a third version of the Budget on 21 May. Still, tensions within the Government of National Unity (GNU) have persisted and political rhetoric is deterring foreign investment flows. Throughout April, the yield on the South African 10-year government bond stayed above 10%, at one point rising above 11% – levels last seen just before the National Election in May 2024.

The spot gold price hit an all-time high of $3 500/ounce on 22 April, pushing the JSE’s Resources sector to levels last seen in late 2022. However, bullion fell back by 6% in the following days as President Trump backtracked on his initial tariff position. Over one year, spot gold has gained about 40% in dollar terms.

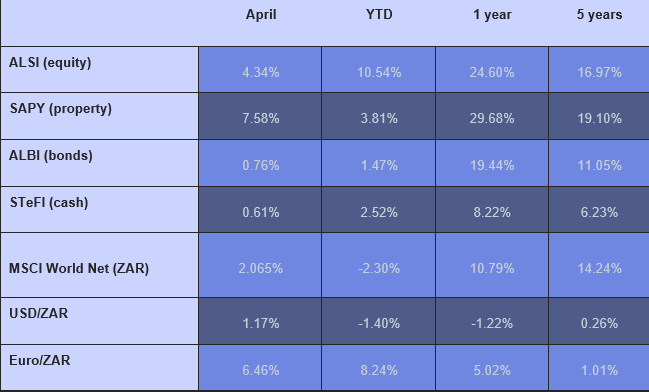

For South African investors, the best investment in April was listed property (as reflected in the SAPY’s 7.58%) return, followed by diversified South African equities (the ALSI gained 4.34% for the month). The MSCI World Net, which is heavily weighted towards the US, gained only 2.06% in rands, partly due to the strengthening of the rand/dollar exchange rate. The JSE All-Share Index and the SAPY were also the top performers over five years. The worst longer-term decision would have been to hold cash, which returned only 6.23%.

Table 1: Total returns to 30 April 2025